Life – Terror. Ecstasy. Fight. Denial. Flight. Failure. PAIN. Forgiveness. Reconciliation. Hope. Love. Peace – Death

Many of us will have begun paying into our pension as soon as we turned 16-21. For those approaching retirement age in the UK, most will benefit from a state pension, which we, our employers and the government will have contributed to over the course of our working life. But thanks to the rising cost of living, pensions are simply inadequate in the UK as well as some other areas of Europe.

Which country offers the most to retirees in comparison to the country’s current cost of living data. We looked at Numbeo data that analyses the average cost of general living expenses like food shopping, the price of a meal at a restaurant, energy bills etc. and gives an estimated cost of living per month, excluding rent.

The data has been calculated on the basis that the majority of pensioners in these countries are mortgage-free. Almond Financial then ranked the top 30 countries in the annual Pension Breakeven Index from the most pension-friendly to the least.

Where in Europe offers the most to residents in terms of pension provision?

Luxembourg tops the European Pension Breakeven Index. The Luxembourg pension system pays out an average of €6,095.87 (£5,211.20) and thanks to the relatively low cost of living in comparison, pensioners can expect a comfortable retirement with a pension income at 538.47% over and above the breakeven point.

Spain came in second place, with the country’s pension system paying out a maximum of €3,175.00 (£2,714.23) per month (nearly three times more than that of the UK) and coupled with the country’s low cost of living, pensioners can enjoy a comfortable retirement in the sun.

The UK moved up one place from last year’s report in the top 30, now coming in at number 15, continuing to linger just above the breakeven point for pension income. At just 18.28% above the breakeven point, the UK pays just £148.13 more in state pension than the average cost of living for a pensioner.

The maximum UK state pension will pay a total of £958.53 per month to retirees from 2024 and at the time of writing, recent data stated that the monthly cost of living for a single person (excluding rent) is £810.40. Giving 2024 UK pensioners a whopping £150 excess to ‘live on’!

Armenia ranked bottom of the Pension Breakeven Index for the second year in a row. The Armenian state pension system pays the equivalent of £70.24 to those eligible, despite average monthly living costs of £505.80. Appearing second last in the index is Moldova with a monthly pension payment of £100.24 per month for retirees, despite average living costs of over £475.90.

Commenting on the results of the research, Principal Financial Adviser at Almond Financial, Sam Robinson, commented: ‘The UK has a system that is just above the breakeven point which means at present, there isn’t much room to manoeuvre for those battling the cost of living crisis. And while it is positive that the UK finds itself among the top half of countries, for how much longer is the question’.

Although the increase in the state pension was well intended, it works out at just £33 more per month compared to last year’s pension. It’s clear that those over 66 need to look at other options rather than just relying on the state pension.

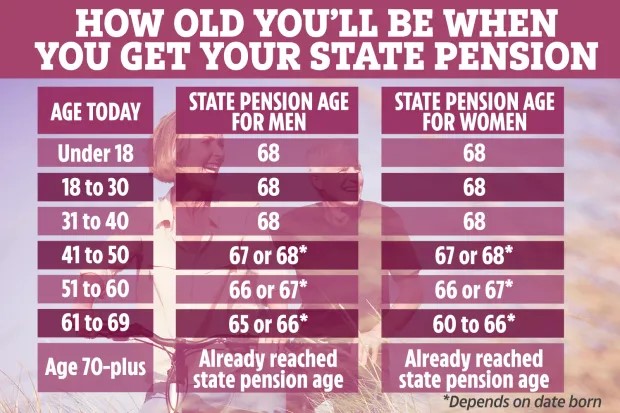

THE state pension age could rise from 68 to 75 if the government takes up the recommendations of a new report, but exactly what age you’ll retire at depends on when you’re born.

The government ‘think-tank‘ reckons this would boost the economy by keeping older generations in work for longer. But the age at which you can get your hands on the government’s state pension has already been slowly rising – particularly for women. For those born before April 6 1950, making you 69-years-old today, the state pension age was 65 for men and 60 for women.

Those born after this date, however, have seen the state pension age gradually rise depending on when they were born – and the age for men and women is now the same. Currently, the state pension age is set to increase to 67 for men and women by 2028, and to 68 between 2044 and 2046.

But it could change again in future as the government announced plans in 2017 to up the state pension age at an even faster rate, to 68 between 2037 and 2039. This has yet to be written into law though and it would need approval by Parliament before any changes could take force. According to the Pensions Act, the state pension age has to be reviewed at least once every five years.

Currently, the amount of state pension you get rises in line with the “triple lock” each year – the greatest of earnings, inflation (consumer prices index), or 2.5 per cent. But there have been talks of the triple lock becoming a double lock or being scrapped altogether, and a new state pension was also introduced for those retiring after April 6, 2016, replacing the former basic state pension.

Thanks for Reading

#Peace

Check what age you’re due to receive your state pension here – government’s calculator