Life – Terror. Ecstasy. Fight. Denial. Flight. Failure. PAIN. Forgiveness. Reconciliation. Hope. Love. Peace – Death

Millennials Confront High Inflation for the First Time. Years of relaxed Bank of England policy have created a bitter generational divide and stoked a huge bubble – now the bill is falling due.

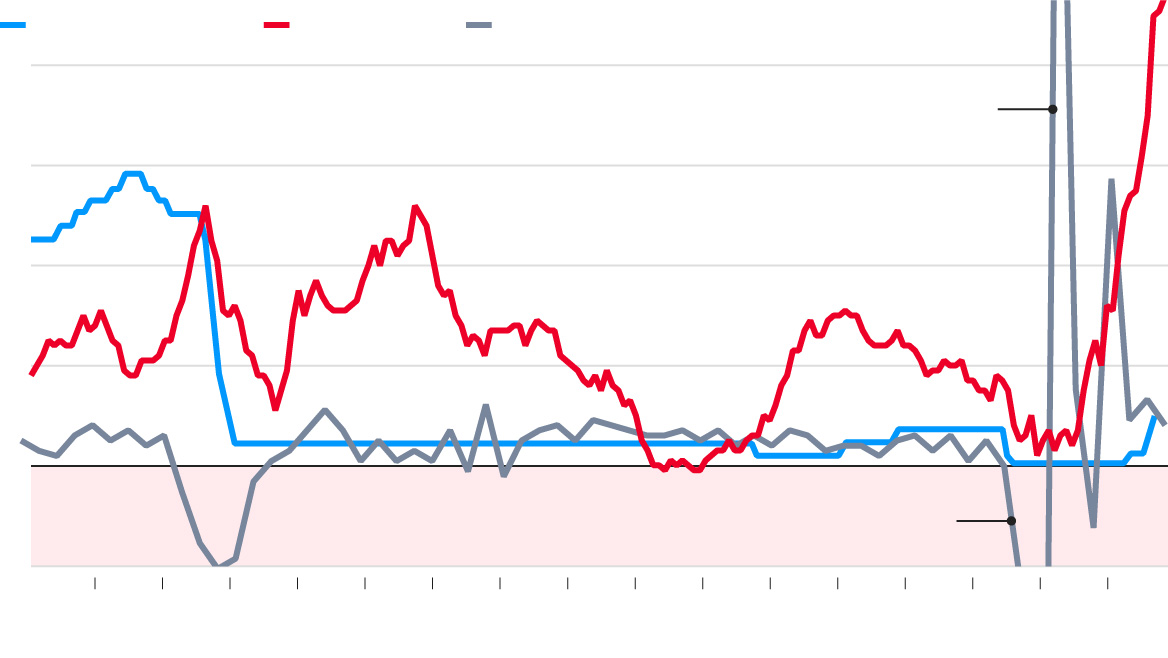

We had lived in a world of near-zero interest rates for 14 years. We had become so used to them, we hardly even discussed them. For the past three years they have finally come to an end as banks around the world grapple with soaring inflation.

Global economics, driven by struggling global economies, US economy, the US Federal Reserve increasing interest rates regularly by 0.75 percentage points, at a time, consecutive rises. Same in the UK, the Bank of England, consecutive rises. Then, unexpectedly its benchmark lending rate is now at 2.5pc. Sunak calls a general election.

Millennials have spent much of their lives enduring economic calamity. Many were children when the dot-com bubble burst; leaving school in the late 2000s, when the property market crumbled; The global financial crash of 2008 and had to compete with a huge generation of baby boomers in an anaemic post-crisis job market before Covid-19 brought the global economy to its knees.

But there was one powerful phenomenon that millennials, in the UK, had never felt, at least as adults: interest rate increases, driven by rapid inflation, resulting in significant rising mortgage rates. My oldest friend, bought his first house in the late ’80’s, his mortgage rate was 17% and he had to jump through so many hoops, kiss so many arses, and be ‘grateful’ for it.

Anyone born from 1981 to 1996 — along with the younger Generation Z — have been wrestling with sharp price increases for the first time since they’ve been old enough to notice. Growth in the Consumer Price Index, a primary measure of inflation, has been rising for months and is touching its highest level since 1991, when boomers (born from 1946 to 1964) were roughly the same age as millennials are now. The closest that inflation has come to that mark since then was in 2008, the last great financial (sub-prime lending) crash when soaring oil prices briefly pushed up the overall index.

At the same time, we seen the launch of the first round of what was then a new-fangled strategy called “quantitative easing”, a polite term for what used to be known as printing money. It was sold as a short-term crisis measure to prevent a re-run of the Great Depression.

Now, supply chain snarls, sky-high consumer demand for goods and worker shortages that are limiting production and lifting wages have pushed up the costs of everyday basics, like food and utilities but also everything else that we have been ‘sold’ within the great capitalism [dream] experiment of the 21st century, furniture, cars, housing and, more or less, everything else you can think of. It’s hard to see when the turmoil might end.

Once everything was back to normal, [when?] the intention was always that interest rates would be dropped again. But the return to ‘normal‘ has never arrived. We are paying a price for rates that remained close to zero for the previous decade, and were then cut again, all the way down to 0.1pc in the UK, to cope with the Covid-19 pandemic. In some countries, such as Sweden and Switzerland, and the eurozone, rates even went below zero. Economic decisions made 14 years ago that disguised the true state of the economy, that we then paid a high price for.

In a through-the-looking-glass financial twist, you actually had to pay the bank to look after your money for you. Nothing like that had ever happened in financial history before.

The price increases have been felt unevenly. Some of the most extreme gains have come in categories where millennials and their younger counterparts are more likely to spend money than older generations. Current energy prices, something that policymakers can do little to control, are up 200-250% [in the UK].

Younger people also tend to be renters, [they cannot afford to buy] leaving them more exposed to rising rents than older generations, who are more likely to be homeowners. They often buy used cars, meaning they have borne the brunt of rising used-vehicle prices that are up 26 percent over the past year. (Baby boomers are more likely to buy new cars, which have gone up in price but not as much.) And while people of all ages are being affected by higher food prices, young adults tend to dedicate more of their money to restaurant meals and other, recreational activities.

Millennials regularly talk about rising prices and goods shortages but don’t seem as frightened as older generations. Part of that may be because they don’t have memories of the last time when inflation was bad — unlike baby boomers, who were just entering the work force during the “Great Inflation” of the 1970s and early 1980s. Members of Generation X mostly missed the Great Inflation but came of age during a period when inflation remained higher than in the 2000s.

Many young adults have also saved money and paid down student loans during the pandemic, when they were stuck at home and, in some [a few] cases, receiving government relief. That may have put them in a better financial position to handle higher prices, at least for a while. But not everyone is able to navigate the moment easily.

UK Food Inflation of 25+% is massively impacting food bills, food prices have risen more than 20% on average. Higher than ‘gross’ inflation? Apart from what is blatant exploitation by stores capitalising, unfairly, on a difficult situation, this is impacting on everybody’s ability to spend money elsewhere.

Even within generations, rising prices don’t hit everyone the same way. Young parents dedicate far more of their monthly budgets to food than people without children, and more than older parents, who tend to be more stable financially.

Low-income families of all generations spend [proportionally] far more of their gross income on housing, energy and other essentials than wealthier families. Then there are the smaller items that together can add up. Most of us don’t regularly use laundrettes, for example, but those who do — a group that’s heavily skewed toward young people, often single mums — spend hundreds of pounds a year there and have seen their costs go up nearly 100 percent over the past few years.

The catch 22 is that if people have a faster pace of inflation, workers need higher pay to cover it — and employers will raise prices further to pay for those raises. Prices and wages on an upward spiral, making a short inflationary burst last even longer.

People who lived through the Great Inflation tend to expect inflation to be higher in the future more than younger generations, surveys show. But price outlooks among those younger than 40 are beginning to climb. Overall confidence in the economy among younger people — who are usually the most optimistic age group — is wavering. It’s a big change for them, since inflation had been on a downdrift since the 1980s.

Well before millennials even came along, we’d been going through this period of declining interest rates, declining inflation, declining expectations. Now that has been upended — at least temporarily, and maybe for a while yet.

Ultra cheap money created a bitter generational divide as soaring house prices made it impossible for younger people to get on the property ladder; it created legions of zombie companies that were kept barely alive on easy credit; it encouraged feckless spending by governments that thought the bills would never fall due; it created an explosion of debt and fuelled asset-price bubbles; and it destroyed the incentive to save.

‘Free’ money might have helped rescue the economy in the wake of the financial crisis of 2008 and 2009. But one day interest rates had to get back to being realistic [normal] – and now is the moment.

“By any historical measure, interest rates have been exceptionally low for the last 14 years,” says Nicholas Crafts, emeritus professor at Warwick University and an expert in British economic history. “Even in the [worldwide depression of the] 1930s they did not go below 2pc, and even that was only for a few years. And yet, over that time, growth and productivity and investment have also been very weak.”

The zero-rate era has lasted far longer than anyone originally thought possible and in reality that has not done us any favours.

Rewind to 2008, with banks around the world crashing, and with the financial system in turmoil, and central banks around the world slashed rates to 300-year lows. From 5pc before the crisis, by March 2009 the Bank of England had taken rates all the way down to just 0.5pc, the lowest level since it was founded in 1694, in an effort to boost the economy. Those on flexi deals ‘boomed‘ those locked into 5, even 10 year fixed deals (recommended at the time by many financial advisors) ‘drowned’.

No one denies the strategy helped the global economy recover from the crash of 2008. After a steep initial fall in output, most developed countries bounced back fairly quickly. The trouble was, as the years went by, financial and asset markets became more and more distorted. Like opioids, zero rates may have been effective in an emergency – but they quickly became addictive and potentially fatal as well.

Take housing, as mortgage rates fell, debt loads became easier and easier to service for anyone who already owned a property, sending prices soaring upwards, and locking a whole generation out of the market. From £157,000 in 2009, by 2021 the price of the average British house had risen to £273,000 even though real wages were broadly stagnant in real terms over those years.

Across the UK, the average deposit needed to buy your first home rose above £50,000 by 2021 and above £70,000 in London. With crazy rent prices who can save £70K for a deposit, without help from their parents, those are unimaginable sums for most under-30s, even if they were in well-paid jobs.

Not very surprisingly, the rate of home ownership, which had been rising through all the post-war period, and accelerated in the era of Thatcher’s home-owning democracy, went into reverse. From 73pc when rates went to zero, it dropped all the way down to 65pc. Even more alarmingly, ownership levels plunged among younger people. The Office for National Statistics found recently that a third of 25 to 44-year-olds are now renting from private landlords compared with fewer than one in ten 20 years earlier.

Sure, perhaps the millennials were spending too much on their smashed avocado brunches and chai lattes to save up for that deposit. And, sure, we don’t build enough homes. But there was no getting away from the real problem. Artificially low interest rates inflated a property bubble that rewarded the old who already owned their houses and punished anyone younger who had not yet got their first foot on the ladder.

In the meantime, governments have borrowed more and more. In the UK, the debt to GDP ratio stood at less than 50pc before the crash. It carried on rising even during the supposed “austerity” of the Cameron-Osborne era, and then shot up again during the pandemic. By this year that had doubled to 101pc, its highest level since the 1960s when we were still paying for the cost of the Second World War.

- Canada. 106.59.

- France. 111.67.

- Germany. 66.54.

- Italy. 144.41.

- Japan. 261.29.

- United Kingdom. 101.36.

- United States. 121.38.

It is even worse elsewhere. In the US, the debt ratio went from 65pc to 121pc over the same period. If it is measured on a global scale, including government, corporate and global debt, the amount the world owes has never been higher. By last year, according to IMF calculations, total global debt had hit $226 trillion, or 256pc of global output.

2024, the world is mired in $315 trillion of debt, according to a report from the Institute of International Finance. This global debt wave has been the biggest, fastest and most wide-ranging rise in debt since World War II, coinciding with the Covid-19 pandemic. More than 80 percentage points higher than it was before rates were slashed to almost nothing. Why not? With money so cheap, it made sense to borrow as much of it as you could.

If that money had been used to invest in new houses, factories, hospitals, warehouses or products that would be fine. There was very little evidence of that. Instead, much of it was used by a rapacious private equity industry that took over companies such as the supermarket chain Morrisons, and venture capital firms puffing up technology businesses to absurd valuations based on little more than some slick PowerPoint presentations and smart-looking apps.

None of that added very much to the productive potential of the economy, nor did it do anything to lift growth. Instead, assets were shuffled from place to place, making the fund managers rich, but leaving the companies they owned withered and emasculated. Typically, the private equity funds starve the companies they buy of investment, load them up with debt, and squeeze every last penny out of them to fuel short-term profits.

At the same time, the power of central banks has grown and grown. From faceless technocrats charged with nothing more than keeping inflation under control and stabilising the financial system, they have acquired rock-star status as they have flooded the world with money and grown and grown…..yet they closed (are still closing) branches?

In this country, Mark Carney [former governor of the Bank of England], the little-missed predecessor to Andrew Bailey, seemed to spend most of his time lecturing anyone who could stay awake about sustainability, diversity and climate change. In the eurozone, Christine Lagarde, the impeccably politically correct president of the ECB, seemed to spend more time worrying about global warming than how to rescue Italy from permanent recession.

No one would argue that steadily raising interest rates would be an easy path. And we may never get back to the 7pc [to as high as 17pc] levels that many who bought their first property in the 1980s or 1990s will painfully remember. Prof Crafts argues that interest rates may be permanently lower than in the past, but, and this is the important caveat, not close to zero as, due to the fragility of the global economy, we have become accustomed to expect.

Looking back on the last 14 years, this is an experiment that failed, another dysfunctional cog in the wider, failed wheel of the Great Capitalism Experiment born out of the Reagan and Thatcher era, and not just in this country but around the world.

Shutting a generation out of the property market, creating a legion of zombie companies, inflating asset bubbles, and creating a debt-fuelled economy kept afloat on a tidal wave of cheap and printed money is hardly a great achievement, nor is it sustainable. It has done nothing for growth, equality, opportunity, or investment except for a few (less than 1%), who have benefitted, and how have they benefitted, whilst the rest of us have not.

The personal wealth of Rishi Sunak and his wife Akshata Murty rose by £122m last year [2023], according to the Sunday Times Rich List. The couple’s fortune was estimated at £651m in the latest list, up from £529m in 2023. This was mainly due to Ms Murty’s shares in Infosys, the Indian IT giant co-founded by her father.

Rishi Sunak, the [non elected] Prime Minister & Torie Party leader may think that rising interest rates are ‘too terrifying’ to contemplate. He is surely wrong about that, as about so much else. Sunak, a wanna be Billionaire, king of the ‘Jacks’ is he the man to vote for on July 4th?

Thanks for reading

Peace

#FuckTheEstablishment

How rock-bottom interest rates are doing more harm than good (telegraph.co.uk)